If you are registered for the DHL e-Billing service, you automatically have access to the MyBill portal. MyBill is a user-friendly portal of DHL Express, which allows you to view and download all your invoices online. As soon as an invoice is created, you will receive an e-mail with the attached invoices in PDF format and a link to MyBill. There you can view and download your invoices in various file formats.

Help with MyBill

Use of MyBill & questions about invoices

You can download the MyBill User Guide here. In the guide will find illustrated step-by-step instructions on the functions of MyBill and how to manage your profile settings and DHL e-Billing users.

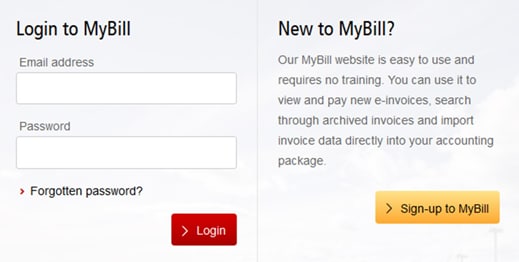

Your username is the e-mail address you registered with. You set the password by yourself. If you have forgotten your password, simply enter your e-mail address as your user name in the log in field on mybill.dhl.com/login and click on "Forgotten password?". Please enter your e-mail address on the following page. After that an e-mail with a temporary password will be sent to you.

In MyBill you can view transport and customs invoices and all customs accompanying documents for your account number(s) and download them in various file formats.

Your online history in MyBill begins with the first invoice you received electronically after your initial registration for DHL e-Billing. There is no history in MyBill for invoices you received before that date.

Step 1: Click on the following link: mybill.dhl.com/login. This will take you directly to the MyBill portal. Enter your user name and password. Your user name is the e-mail address you registered for DHL e-Billing.

Step 2: You will be taken directly to the invoice overview.

Step 3: Simply click on the relevant invoice for which you would like to view the shipment details or easily download the invoice.

The invoices can be downloaded in various file formats (PDF, XML and CSV files for imports into other applications such as your Enterprise Ressource Planning systems). You will find step-by-step instructions for this in the MyBill User Guide.

Various CSV formats are available in MyBill:

For transport invoices:

- CSV: Data in several lines per waybill in order to break down freight charges and surcharges.

- Standard-CSV: all data is in one line.

- Or create a customized CSV file. Learn how to do this in the MyBill CSV Guide.

For customs invoices: Only the standard CSV format is available for customs invoices; unlike transport invoice CSV files, it cannot be individualized. You can also see which data and columns the standard CSV contains in the MyBill CSV Guide.

Log in to MyBill and select the customs invoice associated with the shipment in the invoice overview (invoice number starts with the initial letters ZIT). Click on "download" and check the box "customs documents" in the download section which then appears. You will find step-by-step instructions for this in the MyBill User Guide.

If you continue to receive your customs invoices in paper form, a corresponding download link to the MyBill portal (including access code) will be provided on the invoice. You can use this link to download your customs paperwork.

Did you know that you can also receive the paperwork for your import shipments by e-mail with the service e-Paperwork? Simply register here free of charge.

With DHL e-Billing and e-Paperwork your customs invoices and paperwork are usually available within 24 hours after customs clearance. This enables you to check your imports immediately.

If you would like to process your import shipments using your own deferment account, please get in touch with your sales contact to ensure that the information can be passed on directly to our experts for customs clearance in Leipzig. Please provide your EORI number and e-mail address so that this information can be stored in the appropriate customs clearance system. For import shipments that are processed through your own deferment account, the customs paperwork will not be sent via DHL e-Billing, but another system. Therefore, the e-mail by which you receive your documents looks slightly different.

Yes, simply select the invoice in the invoice overview that appears immediately after logging into MyBill and then click on the particular waybill number (AWB). An image of the waybill will appear.

If you have any questions about an invoice or would like to make a complaint about it, then you are welcome to contact us at the following addresses:

- For transport invoices please send an e-mail to rechnung-de@dpdhl.com

- In case of customs invoices please send an e-mail to zollrechnung-de@dpdhl.com

No, these functions are currently not available.

Note: If you are interested in using the SEPA Direct Debit Scheme, please contact your DHL Express Sales representative.

Registration, profile settings & user administration

If you have not yet registered for DHL e-Billing, you can use this Link (page available in German only) to register with your account number and you will start receiving your invoices by e-mail immediately. Along with e-Paperwork, you will also receive all customs documents relating to your import shipments.

If you/ your company already use DHL e-Billing and would like to add additional users to the service, you can either do this using this form (page available in German only) or log in to MyBill and add the additional users in the "My Account" tab. Find out how to do this in the MyBill User Guide.

The registered e-mail address cannot be changed in your MyBill account settings. In this case, please contact us directly by sending an e-mail to rechnung-de@dpdhl.com or zollrechnung-de@dpdhl.com or contact your DHL Express contact in Sales.

No. Please contact your DHL Express Sales represetative or the DHL Express Customer Service and inform us of any changes in your official company details.

No. For this purpose, please contact your DHL Express contact in Sales.

Technical problems & settings

Yes. We use a combination of digital signatures and powerful encryption technology to ensure data security.

The only requirement for registration with MyBill and using Adobe Acrobat as a PDF reader to view invoices online, is internet access. Since MyBill is web-based, no additional software needs to be installed.

Please make sure that your spam/junk filter does not block e-mails from the following e-mail address: rechnung.de@dhl.com

If the problems persist, add the following IP addresses and domain names used for billing to your white list:

IP-addresses:

85.90.252.61

109.234.201.207

Domain-names:

Domain names used by us for sending are:

fundtech.com, accountis.com, accountis.net and dhl.com

Further sources of error when receiving e-Billing invoices can also be found here (German only).

In case of any technical questions, please contact us by sending an e-mail to rechnung-de@dpdhl.com.

Original documents and issues of Tax Law

Yes. VAT compliance is guaranteed: DHL e-Billing invoices and all other documents provided via MyBill are certified and legally compliant original documents. They comply with the relevant sales tax regulations of customs, the EU and Germany.

Yes, the transmitted tax assessment notice is an original document. DHL Express imports are generally carried out using the ATLAS IT system certified by the General Customs Directorate in accordance with Art. 6 Para. 1 UZK and meets the requirements for automated clearance. Therefore, all customs declarations are transmitted electronically by customs. The tax assessment notice in PDF form is generated by the IT interface certified by the customs authorities and represents the original document. In other words, the tax assessment notices transmitted via DHL e-Billing are just as much original documents as the printed version.

Yes, according with Section 15.11 (1) 2. of the VAT Application Decree, there is no need to worry about providing proof for imports processed via the ATLAS IT system electronically or, if necessary, by printing out the electronically transmitted import duty assessment notice (see article 52 of the VAT Regulation). If there is any doubt about the amount of import VAT deducted as input-tax, the tax authorities can request appropriate information, using the procedure provided by the Federal Ministry of Finance as an online request, from stored import data from the ATLAS System.

Preference certificates (such as EUR. 1, A. TR or For A) basically remain with the shipment. If customs insist on the presentation of the preferences these will be taken from the shipment, presented to customs and subsequently delivered to you by post.

Please also take into consideration that there is a new electronic procedure (REX) which is intended to replace paper in the future. The implementation runs in several steps. There are a total of 5 blocks (time windows) in which multiple countries apply the REX procedure and shippers can register there. The Original documents (ATR, EUR. 1 etc.) are one by one replaced by a number on the commercial invoices of the shipper. For this changeover a transition period of several years has been defined which began on 01.01.2017 and ends on the 31.12.2020.

The invoice in PDF format has an electronic signature. The electronic signature guarantees that the invoice was issued by DHL.

Questions about the DHL e-Billing service

No. You will no longer receive printed invoices, but of course you have the option of printing out your invoices if necessary.

If you have any questions, you can contact the following e-mail addresses:

- rechnung-de@dpdhl.com for transport invoices or technical questions

- zollrechnung-de@dpdhl.com for customs invoices