To whom are the goods of a shipment with PDDP service cleared through customs?

When customs clearance is carried out using the PDDP service, the goods are cleared in the name of the recipient.

Thank you for your feedback.

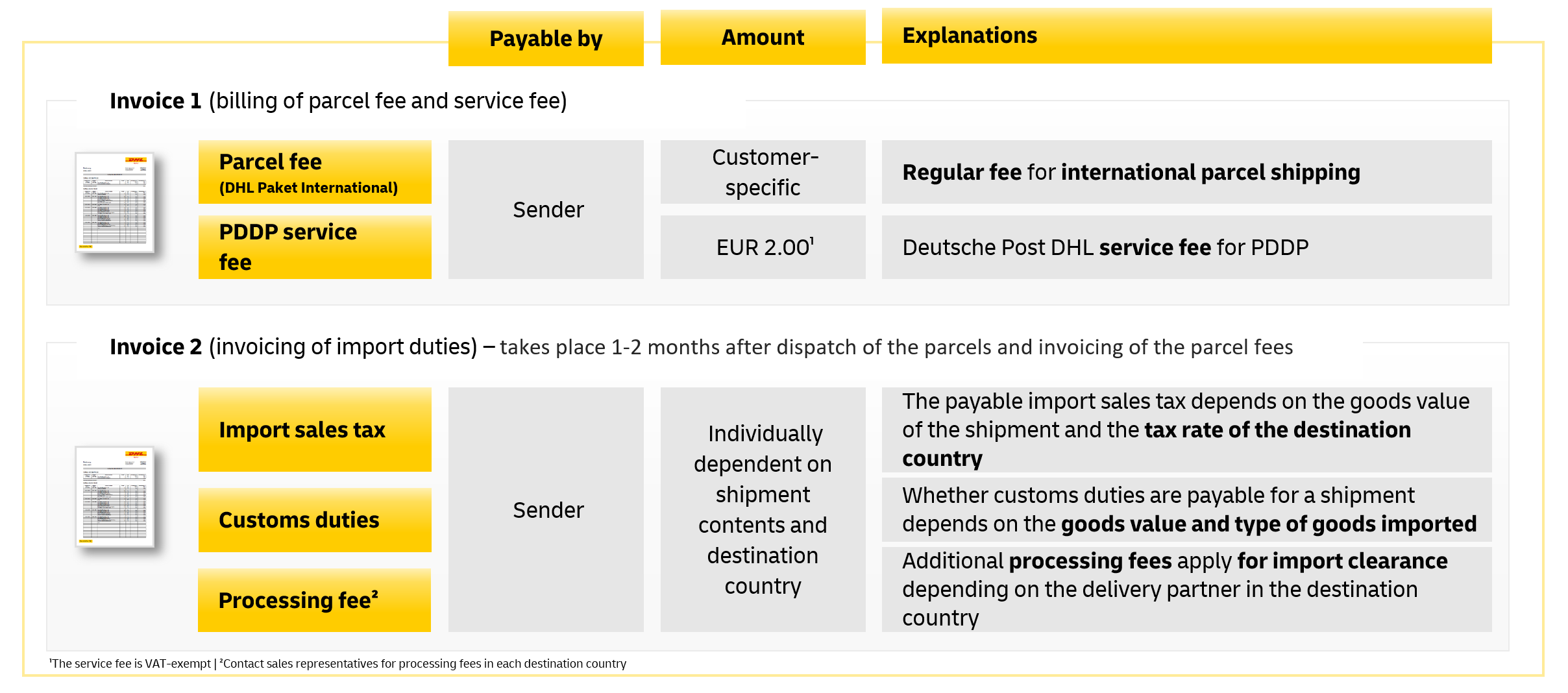

How are the PDDP service fee and import duties invoiced?

The PDDP service fee is billed at the same time as the parcel fee and the other services. The customs duties and processing fees are invoiced separately.

Thank you for your feedback.

In which currency is billing carried out, and how do you handle exchange rate fluctuations?

We recommend entering all customs information in the currency of the respective destination country. Invoicing of the customs and processing fees are handled by the "qualified party", also in the currency of the destination country. These fees are invoiced to our company and subsequently charged on to you in euros based on the exchange rate on the date of invoice.

Thank you for your feedback.

How much is 800 USD or 135 GBP in EUR?

800 USD is approximately 650 EUR. 135 GBP is approximately 140 EUR. Due to fluctuating exchange rates, we kindly ask you to declare your goods in the destination country’s currency.

Thank you for your feedback.

What happens if, as an in-house programmer, I register a shipment without PDDP that has a goods value of below USD 800?

If you register a shipment without the PDDP shipping service and the entered goods value is at or below USD 800, the shipment will be returned to you and no customs duties are payable.

Thank you for your feedback.

What requirements and steps must be observed for DLS handling when using the PDDP service?

The following requirements and steps must be observed with the PDDP service:

- The PDDP service can be optionally booked at the shipment level and must be transmitted in the EDI message.

- The service is transmitted with the corresponding product keys.

- The goods tariff numbers must be entered for the Postal DDP service.

- Entry of the shipment type is mandatory in connection with the PDDP service, and only the value 11 (merchandise shipment) is permissible.

- The relevant PDDP logo must be printed on the label.

- The product feature code 128 (see the current barcode specification) for the PDDP service must be stated in the routing code.

Thank you for your feedback.